Capacity Factor, May 2024

We've got a slightly shorter Capacity Factor for our readers this month—heavy on the energy sector. We'll be back with more updates from the housing sector next month. Until then...

Advait Arun — Rethinking Utilities Financing

A recent Bloomberg article on the physical risks facing utility investments—wildfires, storms, droughts, and so on—is yet another item in the fast-growing list of the institutions and systems that climate change threatens to upend. Bloomberg highlights how utility stocks have plunged after disasters, in Hawaii, in California, in Texas, in Oregon.

However, mostly thanks to the fact that state governments prop up utility companies to ensure they remain solvent, the average bond spreads in the utility sector have not climbed too much. Thanks to that, utilities are now borrowing more and more “to upgrade aging infrastructure and pay off claims.” But, for a few embattled utilities, the interest on some of this new debt is expensive, and, in general, credit rating agencies are more likely to downgrade utilities after weather events, exacerbating their credit crunches. The financial landscape is shifting.

Bloomberg produced three charts that summarize this situation: utilities are taking on lots more debt relative to their equity capitalization, increasing their leverage, in order to undertake significantly higher capital expenditure, cutting into their free cash flows.

The good news here—really!—is that capital expenditure is up. We should want utilities to spend on drought adaptation and wildfire mitigation and transmission line protection and all the rest. This is what resilience requires. The bad news, of course, is that all of this necessary debt-financed spending comes at a severe cost to utilities’ balance sheets. Creditors (and credit rating agencies) will be spooked into charging higher interest rates on those debts by rising climate risks and falling free cash flows: less cash on hand means less reason for creditors to believe that a utility will be able to pay off its debts. This spending also comes at a cost to ratepayers, whose monthly utility bills will rise sharply to help utilities cover the cost of their capital expenditures.

In my mind, the first, best, and most obvious solution is to ensure that these utilities can secure cheaper debt financing. The Department of Energy’s Loan Programs Office is now indispensable in this regard—the SEFI Carveout and the Energy Infrastructure Reinvestment programs provide a volume of low-cost debt that utilities could never secure from private creditors. This is a start; states and the federal government can do more, of course.

The second half of this problem, however, is that many utilities fund their debt repayments (and shareholder dividends) by charging ratepayers. This is why utility-sector debt is treated as safe in the first place. But is it equitable to hike people’s electricity rates to foot the bill for climate adaptation? The way out of this bind likely requires states to shield ratepayers by subsidizing critical capital expenditures—and operational expenditures, for increasingly frequent maintenance and upkeep needs—through cost-share and guarantee arrangements.

But that kind of policy intervention raises the question:why are most of our utilities privatized and beholden to private creditors and shareholders when they clearly require so much public attention?

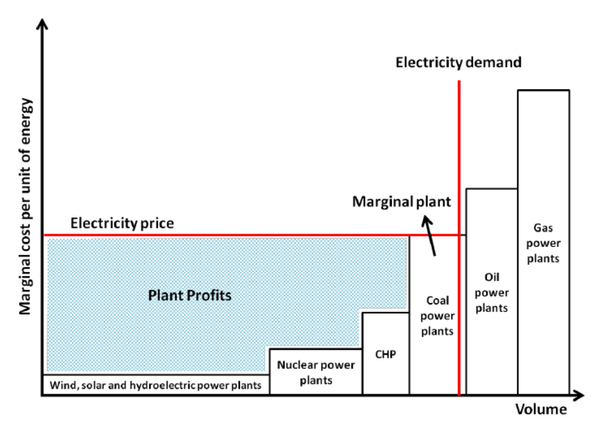

Yakov Feygin — Floors and Ceilings

Utility Dive has run several stories over the past few months about the impact of high interest rates on the renewable energy industry. It’s now well known that high rates hamper renewable energy project development: these capital-intensive, long duration investments are very rate-sensitive. What made this article stand out was a few interesting points made by Raj Prabhu of Mercom Capital Group as he describes how markets are pulled between long-term demand and short-term supply factors:

“It’s confusing,” he said. “Things are so good that everyone wants to do a project because they see the future, they see the signs. But if everyone gets on the road there’s going to be a traffic jam, and that’s what is happening.”

Solar manufacturing, Prabhu said, started into its own version of this cycle last year. IRA incentives spurred a boom in manufacturing announcements in the U.S., but the increase in capacity simply caused solar module prices — including prices for equipment from China — to fall. Some manufacturers have already canceled plans for expansion in the U.S. as the rush to make solar panels caused module prices to fall to a point that additional manufacturing capacity is no longer viable even with the IRA incentives, Prabhu said. Falling prices have also spurred talk of restoring tariffs on imported solar panels.

This quote is very useful because it gets to the crux of how capital investment is inherently unstable. It is undertaken by profit seeking firms which respond to demand. But too many entrants at once leads to a crash in prices and, in turn, the investments required to meet longer-term demand might not be undertaken by those entrants in the first place. IRA incentives help with this problem by lowering the threshold for firms to invest, but they are not always enough because they don’t necessarily work to coordinate these firms’ decisions.

One solution to this problem might be to encourage some floor price for solar modules via a guaranteed purchase agreement from a big customer. The biggest customer, of course, is the government. Commodity reserves are well known instruments of economic policy and, recently, the Biden Administration has been experimenting with using the US strategic petroleum reserve to regulate the investment dynamics in the oil industry by setting a floor and ceiling for oil prices.

One can imagine some kind of national critical energy component reserve meant to guarantee a floor price for and a long term supply of key grid components. In fact, section 20301 of the House’s 2021 COMPETES Act established a strategic transformer reserve. Of course, the flip side of a floor is a ceiling, wherein the reserve entity sells its inventory to force higher prices down. To be sure, creating a manufactured component reserve faces operational issues, including how its managers would deal with standardizing technologies in ways that would not jeopardize innovation, and what to do with obsolete components. That said, these remain important questions to think through for anyone who wants to see an IRA 2.0.

Chirag Lala — Interconnection reforms and transmission planning

When energy generation developers file requests to have their projects get connected to the transmission grid, the grid operator must study their projects to determine the stresses they might place on the existing bulk transmission system. This process is potentially quite onerous: grid operators may judge that connecting a project to the grid requires additional grid upgrades due to its particular operating profile. In this case, applicants are charged for upgrades in accordance with the cost-causation principle, which states that the project whose study identifies the need for an upgrade to the grid must pay for the entirety of that upgrade.

The status quo interconnection process increases investment uncertainty in numerous ways. It is hard for projects to know in advance what upgrades will be asked of them—especially if projects ahead of them in the queue were already asked to pay for upgrades. In other words, a project’s position in the queue can be the difference between a profitable investment and a dead project. Sometimes investors might find it advantageous to be further back in the queue if their competitors are forced to make network upgrades that they can use. Conversely, if projects are asked to pay for more upgrades than anticipated, the resulting additional costs could overwhelm their finances, leading developers to not undertake the project to begin with. Consequently, the transmission system is not upgraded ahead of anticipated needs, nor is its expansion predictable or otherwise expeditious.

In April, the Department of Energy (DOE) published its Transmission Interconnection Roadmap, which describes a list of pathways to address growing interconnection queues, delays, and costs. Three proposals to reduce interconnecting projects’ investment uncertainty caught my eye (Solutions 3.1 - 3.3):

- Short-term: Plan more transmission network upgrades in advance of interconnection requests and have some combination of ratepayer, state, or federal sources pay for the upgrades, in addition to interconnecting projects.

- Medium-term: Allow projects meeting certain reliability requirements or which agree to be re-dispatched (have their operating profile changed) to interconnect without having to make network upgrades.

- Long-term: De-link interconnection processes and the network upgrade process entirely.

These proposals would radically reshape how we expand, maintain, and manage the grid. They envision a transmission system that sizes, builds, and pays for network upgrades separately from the interconnection requests of bulk generation and storage projects. Not only would this create spare grid capacity, it would encourage the standardization of resources by allowing them to be more “plug and play” products (also known as “connect and manage”) rather than bespoke projects. (Similar proposals also exist for distributional systems and DERs, dubbed “integrated planning.”) DOE isn’t alone in considering these changes to the transmission system. The roadmap dubs these longer-term aims “a radical departure from current practice in most jurisdictions.” Seeing as transmission is the Achilles Heel of America’s energy transition, it’s good news that the DOE recognizes the stakes of this problem.